Browsing the Complexities of Bankruptcy Discharge: The Importance of Specialist Support in Achieving a New Beginning

Navigating the elaborate landscape of bankruptcy discharge can be a challenging job for people looking for a monetary fresh begin. By enlisting expert advice, people can navigate the complexities of insolvency discharge with self-confidence and enhance their opportunities of attaining the fresh beginning they seek.

Understanding Personal Bankruptcy Discharge Process

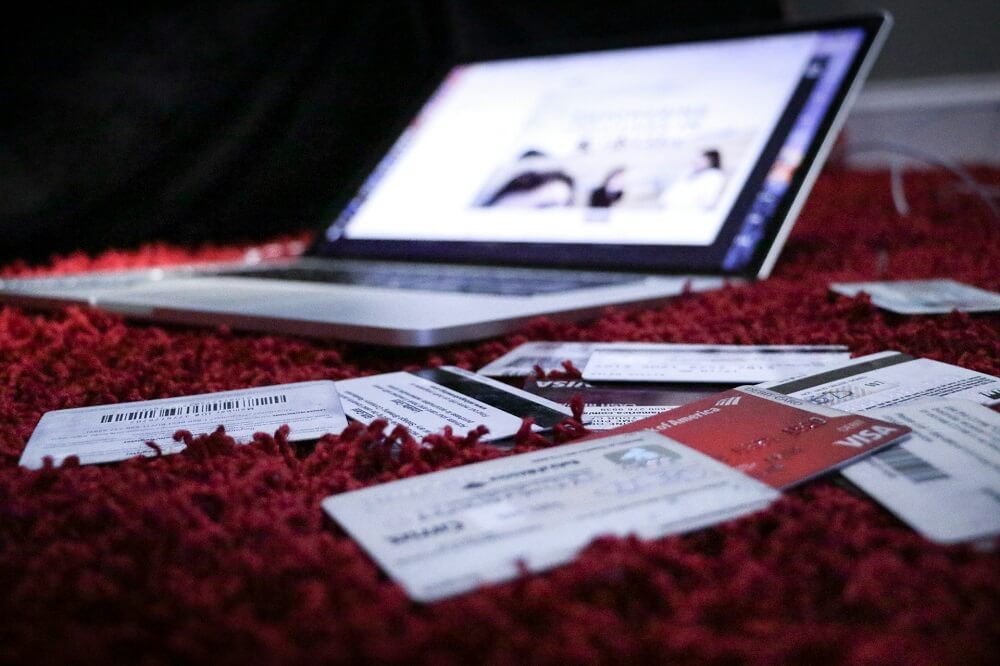

The insolvency discharge process is an essential stage in the lawful treatment where financial debts are absolved or discharged, giving individuals with a fresh monetary beginning. This process marks the culmination of a personal bankruptcy case, signaling the resolution of financial obligations for the filer. When an insolvency discharge is provided, the borrower is relieved of the obligation to settle specific financial obligations, using a course to reconstruct their economic standing.

To initiate the insolvency discharge procedure, the borrower needs to first submit an application for personal bankruptcy with the court. This application causes an automatic remain, stopping lender collection actions and offering the borrower with breathing area to browse the complicated insolvency process. Subsequently, the court will assess the situation to establish the filer's eligibility for discharge based upon the kind of personal bankruptcy filed, adherence to court needs, and other appropriate factors.

Upon successful conclusion of the bankruptcy discharge procedure, the court problems an order discharging the qualified financial debts, granting the borrower a new beginning financially. It is important for people navigating personal bankruptcy to comprehend the discharge process totally and seek specialist guidance to make certain a smooth shift towards financial recuperation.

Benefits of Specialist Assistance

For individuals navigating the intricacies of bankruptcy, looking for expert advice can considerably boost their understanding of the process and increase the probability of a successful financial recuperation. Expert support offers an organized approach tailored to specific conditions, supplying quality on the different alternatives readily available and the effects of each decision. Insolvency regulations are elaborate and subject to regular adjustments, making it important to have a well-informed consultant that can interpret the lawful lingo and browse the complexities of the system.

Moreover, specialist advisors bring a wealth of experience to the table, having functioned with countless clients dealing with comparable challenges. Their insights can aid individuals expect prospective barriers, strategy ahead to alleviate threats, and strategize for a smoother bankruptcy process. Furthermore, professionals can help in preparing the called for documentation accurately and in a prompt way, minimizing the chance of mistakes that can postpone the discharge procedure.

Ultimately, the benefits of specialist assistance extend past just the technological facets, supplying psychological assistance and reassurance throughout a challenging period. By enlisting the aid of experienced professionals, individuals can approach bankruptcy discharge with confidence and raise their opportunities of achieving a clean slate.

Complexities of Legal Needs

Browsing via the ins and outs of insolvency discharge mandates a deep understanding of the complicated legal needs that underpin the process. Personal bankruptcy regulation includes a web of policies and statutes that govern the qualification requirements, filing treatments, and discharge problems. One vital lawful requirement is the methods test, which identifies whether a private receives Phase 7 insolvency based upon their revenue and expenditures. Furthermore, understanding the various kinds of financial obligations, such as concern, secured, and unsafe financial obligations, is important in navigating the bankruptcy procedure. Each kind of financial debt carries distinctive legal effects that can affect the discharge outcome.

In addition, compliance with court procedures, disclosure requirements, and timelines is paramount in ensuring an effective bankruptcy discharge. Looking for skilled lawful support is essential in browsing the complexities of insolvency discharge. contact us today.

Ensuring Desirable Result

To accomplish a beneficial outcome in the bankruptcy discharge procedure, critical planning and careful interest to detail are important. The first action in the direction of ensuring an effective personal bankruptcy discharge is to properly finish all required paperwork and divulge all relevant financial information. This includes providing in-depth details regarding assets, liabilities, revenue, and costs. Any mistakes or omissions can threaten the end redirected here result of the discharge process.

Seeking advice from knowledgeable bankruptcy lawyers or financial advisors can assist individuals browse the complexities of the personal bankruptcy discharge procedure and increase the probability of a positive result. By complying with these steps and looking for professional aid, individuals can enhance their opportunities of acquiring a successful insolvency discharge.

Expert Support for Financial Clean Slate

Seeking specialist assistance from seasoned bankruptcy attorneys or economic experts is important in accomplishing an effective financial new beginning post-bankruptcy. contact us today. These specialists have the understanding and experience needed to browse the complexities of personal bankruptcy discharge and offer invaluable assistance in rebuilding your monetary future

Financial consultants, navigate here on the other hand, deal individualized economic preparation to help you regain control of your funds after personal bankruptcy. They can help in developing a budget plan, establishing monetary objectives, and developing approaches to reconstruct your credit history. By leveraging their know-how, you can make educated decisions that lay the groundwork for a thriving and secure financial future. To conclude, getting the support of these specialists is vital in setting on your own up for success after insolvency.

Final Thought

In final thought, looking for specialist support is vital for browsing the complexities of the insolvency discharge process. Expert advice can help individuals recognize the legal demands, make certain a desirable outcome, and eventually achieve an economic new beginning. By depending on the competence of specialists, people can better navigate the complexities of insolvency discharge and set themselves up for success in reconstructing their economic future.

Browsing the complex landscape of insolvency discharge can be a complicated task for individuals seeking a monetary fresh beginning.The personal bankruptcy discharge procedure is a critical stage in the lawful procedure where financial debts are relieved or released, giving people with a fresh economic beginning.To initiate the personal bankruptcy discharge procedure, the borrower has to initially submit next an application for personal bankruptcy with the court. Looking for support from seasoned personal bankruptcy lawyers or monetary consultants can help individuals browse the intricacies of the insolvency discharge procedure and enhance the possibility of a beneficial result. By relying on the experience of specialists, individuals can better browse the intricacies of insolvency discharge and set themselves up for success in rebuilding their financial future.